Medicare Part D

What Is Medicare Part D?

Medicare Part D is the part of Medicare that deals with your prescription drug coverage. You will need a Part D prescription drug plan in order to have coverage for any drugs you will be picking up at the pharmacy. There are many different things to consider when choosing your Part D plan, below we will go over all you will need to know about Medicare Part D. If you would like to get a more detailed and specific breakdown for your situation you can call us at 866-319-5886.

You do not get enrolled into Part D of Medicare with Social Security, like Medicare Parts A and B. Prescription drug plans are private plans that you will purchase from a private insurance company. If you have a Medicare supplement, you will need a separate Part D plan. There are some Medicare Advantage Plans that also cover prescriptions.

Who Can Enroll In Medicare Part D?

Only people who are eligible for Medicare can enroll into a Part D drug plan. You will need to be enrolled into Medicare Part A and/or B for you to be eligible for Medicare Part D.

When Can You Enroll Into A Part D Plan?

There are specific times when Medicare Beneficiaries can get enrolled into a plan if they are enrolled into Medicare Part A and/or B.

- Your Initial Enrollment Period (IEP)– Generally speaking for most people, your IEP starts the three months before your 65th birthday and lasts for the three months after your birth month. This is your seven month window and is the best time to get enrolled.

- During the Annual Election Period (AEP)– If you did not enroll during your Initial Enrollment Period, you will be able to enroll once each year during the AEP. This period goes from October 15th to December 7th every year. This is also the time that you can re-evaluate the plan you have and choose a different plan for the following year.

- Special Election Period

What Are Special Election Periods?

A Special Election Period (SEP) is a designed to work with a specific set of circumstances providing you a chance to enroll, disenroll, or change your Part D prescription plan. Here are a few examples of an SEP:

- You move out of your plan’s service area

- Your Part D plan is longer contracted with Medicare

- You have creditable prescription coverage but are losing it (like an employer plan)

- You qualify for Medicare Extra Help

- You will be living in a nursing home or other medical facility

One other SEP is the 5-Star Special Election Period. Drug plans have a 5 star rating system ranging from 1 to 5 with a 5 star rating being the best.

If your plan isn’t a 5-Star rated plan or if your plan has been downgraded from a 5-star rating, you can change your provider one time between December 8th and November 30th.

Medicare Part D Cost

A big question we get is “How much does Medicare Part D Cost?” and the answer to that varies from person to person.

There are several factors that make up your Part D Medicare costs. You will have a montly premium for the plan and you will have certain cost-sharing for the medications you get at your pharmacy. Some plans have a drug deductible and co-pays that will apply for certain drugs.

Medicare Part D Premiums

If you purchase a separate Prescription Drug Plan (PDP) you will have a monthly premium. That premium is determined by the insurance company for the plan that you choose.

Your PDP options are determined by the zip code you live in. For most people, you will have close to 20 or more options to choose from. These plans can range from $10 per month to well over $100 per month just in monthly premiums. These drug plans all have a formulary that is set by the insurance company to determine what drugs will be covered. This is a big factor for insurance companies when setting a monthly premium for the plan.

Going with the cheapest monthly premium for your plan is not always the best idea. We suggest that you contact us at 866-319-5886 and we will help you find a plan that will be appropriate for you. We will go over your current medications and make sure that you get the right plan that will cover the drugs you need.

Some people with a higher income may have to pay more for their Part D plan. If you are earning more than $85,000 as an individual or $170,000 jointly, Medicare will require you to pay extra for your Part D. This is better known as the Income Related Monthly Adjusted Amount or IRMAA.

Medicare Part D Cost-Sharing

When you go to the pharmacy you will have to pay a certain dollar amount towards your prescriptions. Some of these plans have a drug deductible and copays for your medications.

Medicare Part D Deductible

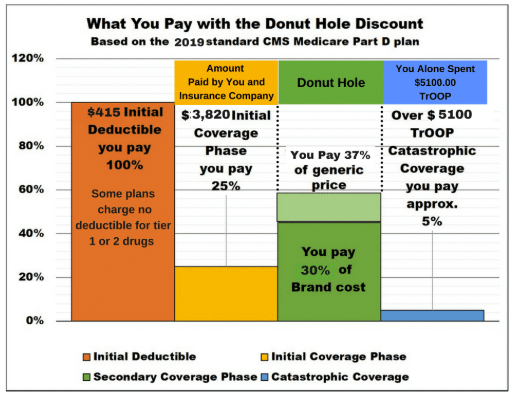

Medicare has specific standard guidelines that have been set for Medicare Part D plans each year. These are the minimum standards set that every company must follow. There are four stages set for drug plans and Medicare determines the threshold for these stages.

The first stage is the Medicare Part D deductible. The deductible set for 2019 is $415. This means that insurance companies can charge up to a $415 deductible for a drug plan before certain benefits kick in. Insurance companies can charge a smaller deductible if they would like but not any more than what Medicare has decided for that year.

Just like most insurance plans, the higher the deductible attached to the plan will usually result in a lower monthly premium. Again, we encourage that you speak with an agent when determining your best option.

Medicare Part D Copays

Medicare Part D plans have tiers which put drugs into certain categories that determine what customers will pay for those prescriptions at the pharmacy. Drugs will fall into four different tiers:

- Tier 1- Generic drugs that will be the least expensive in the formulary.

- Tier 2- Preferred drugs that are brand named and are considered to be more effective than generic options

- Tier 3- Non-Preferred drugs that are brand name but not considered the most effective.

- Tier 4- Specialty drugs that are the most expensive that are brand name.

Not every drug will fall into the same tier from one plan to the next. For instance Lisinopril could be a Tier 1 with one company but not the next. This is why it is important to speak with an agent to look up your prescriptions or you can also visit www.medicare.gov and put in your info to see what your costs will be.

Extra Help For Part D Costs

Prescriptions can become very expensive for and for some people it may seem to be too much. The government has put together a program called the Low-Income Subsidy. If you would like to apply for this you can but you will have to prove your income with Social Security. Your annual income will have to be below 150% of the Federal Poverty Level for your household size.

People who qualify for help will get help paying for their monthly premiums, annual Part D deductible, and also your copays for your prescriptions. You will get a notice letting you know what level of help you will qualify for.

If you think that you might qualify, it would be in your best interest to contact Social Security to apply.

The Part D Coverage Gap "Donut Hole"

Part D plans have what is called the coverage gap or “donut hole”. After you have hit a certain dollar amount in drug costs the plan will have a temporary limit on how much will be covered on drugs.

Not everyone will hit the coverage gap and it can change from year to year based on Medicare’s limits and it also depends on your medication needs from year to year. The initial coverage limit for 2019 is $3,820. This is the total amount spent between you and your plan on covered drugs and after you have hit that total you enter the coverage gap. If you are getting Extra Help you will not go into the coverage gap.

Below is an example for the 2019 Donut Hole.

Which Part D Plan Is Right For Me?

For almost every person there are dozens of plans to choose from. We are able to help people compare their options after looking into your specific needs by using a drug plan comparison tool. This helps us determine which company is the best fit for the the prescriptions you are taking and will offer you the best price for those drugs annually.

Not every agent is willing to help customers with obtaining their drug coverage due to the extra certifications and low commissions. Here at Lange Insurance Consulting, our goal is to make sure our customer is fully satisfied with their health coverage and will help every one of our Medicare supplement plan clients that would like our help to ensure they have the right drug coverage. Give us a call at 866-319-5886 or to request for help click below.