What is Medigap Plan A?

Medigap Plan A is most often found as the most affordable Medigap option available. This is because it offers the least amount of benefits in comparison to every other Medigap plan. Just like with most insurance the more benefits means a higher cost to you. In this post we will go over in detail Medicare supplement Plan A. You can call or text us at 866-319-5886 for a personal consultation.

Medicare Supplement Plan A is required by federal law to be offered by any insurance provider that offers Medigap. Medigap Plan A is your most basic plan of all Medigap plans and from there the plans are structured by CMS to offer a certain amount of benefits with each of them being a little different.

What does Medigap Plan A Cover?

Medigap plans are designed to help cover some of the “gaps” in coverage that are passed on to you from Original Medicare. Medicare Parts A & B only cover so much of your medical costs and then after that the remainder of those bills come to you. If you have a Medigap Plan you will have some of those costs taken care of by the plan depending on which you decide to go with.

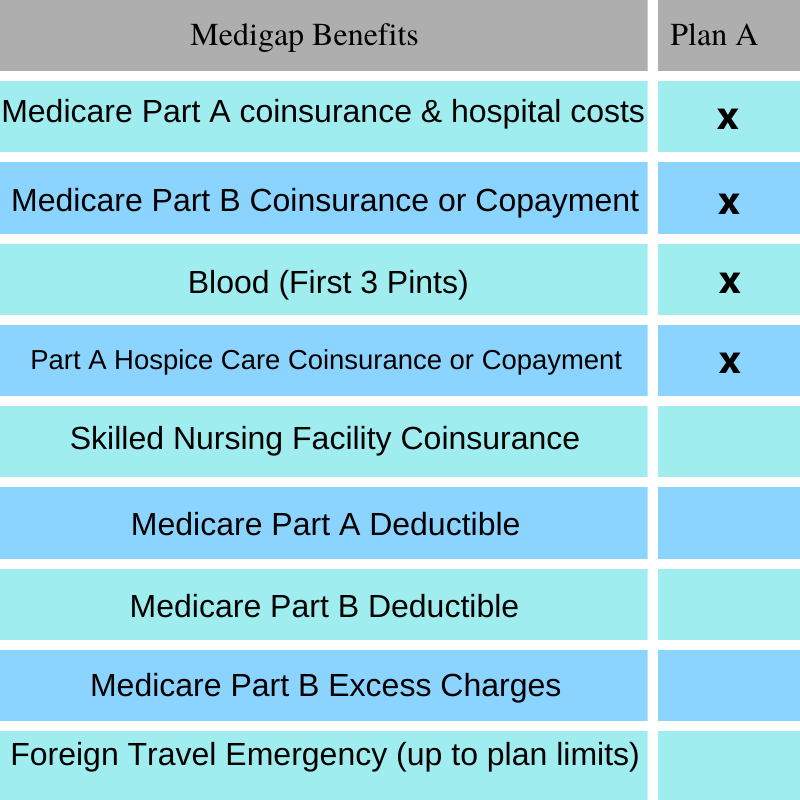

These expenses are paid 100% by Medigap Plan A:

- Medicare Part A coinsurance and hospital costs ( up to 365 additional days beyond typical Medicare benefits)

- First 3 pints of blood

- Medicare Part B Coinsurance and copayment

- Coinsurance for hospice care under Medicare Part A

Medicare Part A VS Medigap Plan A

Remember that Medicare Part A is not the same as Medigap Plan A. Medicare Part A is one half of what is considered Original Medicare. This helps cover your hospital stays and skilled nursing facility care. Visit HERE to learn more about Part A.

Medigap Plan A is one of the supplemental plans you can choose from to help cover the gaps in your Original Medicare coverage. This is an optional purchase and is sold as a private plan.

Why Choose Medicare Supplement Plan A?

Medicare Parts A and B only offer so much help to all Medicare recipients. Choosing a Medicare supplement helps relieve those financial burdens that would be passed on to you. Although Plan A is still the least comprehensive of all the Medicare supplement plans it would still help you relieve some of your costs from Original Medicare.

So if you are someone that is living on a tight budget or would like to just keep costs down while still getting a few extra benefits this may be for you. Medicare supplement plan A will help relieve some of the most expensive out of pocket costs you would experience from Medicare.

Looking To Enroll In Plan A?

Are you trying to decide if Medigap Plan A is the right fit for you? Give us a call at 866-319-5886 or fill out the form below and we will be happy to help you decide which Medicare supplement will be the best option for you.