What is Medigap Plan C?

Medigap Plan C is one of the 10 standardized Medigap plans available in most states across the country. Plan C is the most comprehensive option other than Plan F. This plan gives you peace of mind by covering almost all of the unexpected costs that are passed on to you from Original Medicare. Give us a call at 866-319-5886 and we will be happy to help you compare pricing from all of the carriers in your area. In this post we will help you better understand if a Medicare supplement Plan C is the right fit for you.

Medicare helps seniors get affordable health coverage but it will not cover all of your expenses, which is sometimes the belief. Medicare’s Part A & B will cover generally about 80% of your costs and the rest will be passed on to you. That is when having a Medicare supplement (Medigap Plan) will help you. There are 10 different plans available in depending on where you live that can help you cover these costs. There are deductibles, copays and coinsurance that are passed on to the consumer and a Medigap plan is there to help cover those gaps in coverage and reduce your out-of-pocket costs.

What Does Medicare Supplement Plan C Cover?

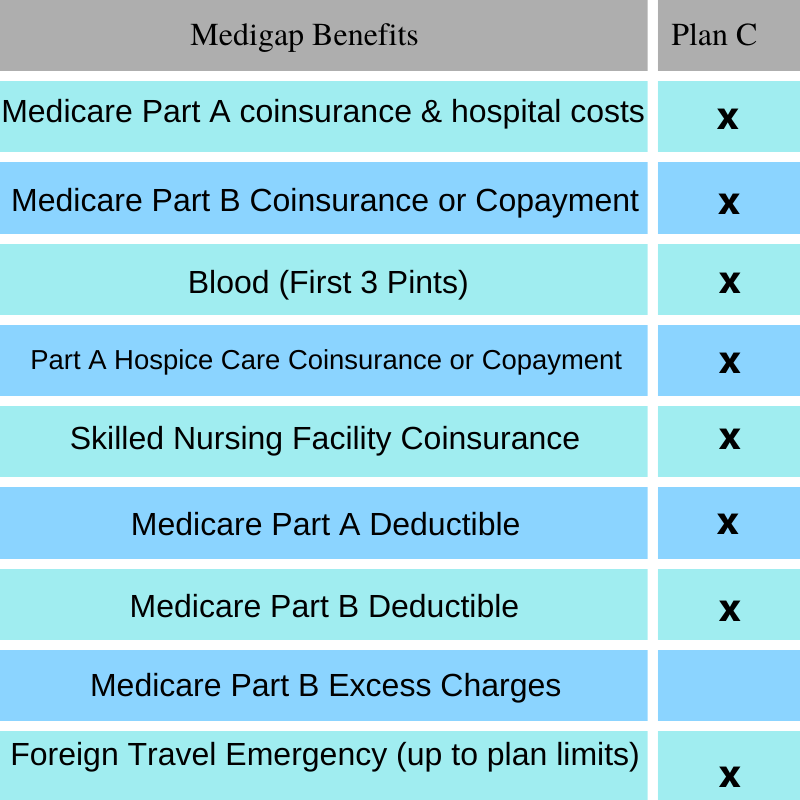

Medigap Plan C covers the following benefits:

- Medicare Part A Coinsurance and Hospital Costs ( Up to 365 additional days beyond typical Medicare benefits)

- Medicare Part B Coinsurance and Copayment

- First 3 pints of blood

- Coinsurance for Hospice care under Medicare part A

- Coinsurance for skilled nursing facilities

- Medicare Part A deductible

- Medicare Part B deductible

Foreign travel emergency coverage (80% of approved costs up to plan limits)

What Does Medigap Plan C Not Cover?

Other than Medigap Plan F, Medicare Supplement Plan C will provide you with the most benefits. The only difference between Plan F and Plan C Medicare supplements is that a Plan C Medicare supplement does not provide coverage for Medicare Part B Excess Charges.

Medicare Part B excess charges apply to doctors who charge more than what the Medicare approved amount for services. In most states across the country, doctors have the option to charge up to 15% more than the Medicare assigned fee. In this case, the extra 15% charge is then passed on to you the patient. For example: You go to a specialist that does not accept Medicare assignment and have a few tests or procedures done. The doctor wants to charge you 15% more than the $1,000 Medicare approved amount. You may have to pay up to $150 more out of your pocket.

Medicare supplements plans F and G are the only supplements that provide coverage for the Medicare Part B Excess Charge.

Remember that Medicare Plan C is not the same thing as Medicare Part C. Medicare Part C is also referred to as a Medicare Advantage Plan and is not a Medicare supplement. You can not have a Medicare advantage Part C plan and a Medicare supplement plan at the same time. If this confuses you at all please call us (866) 319-5886 and we will be happy to help you.

When Can I Enroll Into a Medigap Plan C?

When you first enroll into Medicare you can enroll into a Medicare Supplement Plan C during your six-month Medigap Open Enrollment Period. This is the ideal time to do so because in most cases insurance companies are required to accept your application and can’t look back on your health history to increase your monthly cost. They also can’t use any pre-existing health conditions to deny your application for a Medicare supplement policy during this period.

Your open enrollment period for a Medigap plan starts during the month you turn at least 65 years old and have been enrolled into Medicare Part B. The plans and prices available to you will be determined by the area you live in.

You can always switch to another Medigap plan if you are looking to save money. Keep in mind that if you are looking to switch from one company to the next that you may have to pass underwriting and health questions. Once you are no longer in your open enrollment period your health will play a factor as to whether you are approved for a new Medigap plan. Some people believe they have to wait until the Annual Election Period (AEP) to switch but that is for Medicare Advantage and Prescription Drug Plans. Please get in touch with a professional before making any changes to your current plan. You should never cancel any policy until you know what your options are. Cancelling a policy without knowing that you will be accepted by another plan can leave you with many out of pocket costs that may cause serious financial stress. We are happy to help you look at all of your options and walk you through the process if a switch is needed.

Who Should Buy a Medigap Plan C?

Medicare Supplement Plan C is a good fit for people looking for the maximum amount of benefits with the slight risk of a doctor charging more than the Medicare approved amount. You can always ask your doctor before receiving any services if they accept “Medicare assignment”.

Typically, the more benefits you get from your plan, you can expect a little bit of an increase on your monthly cost. If you don’t mind paying a few dollars more a month for the added benefits and peace of mind, this might be the plan for you.

Ready To Enroll In a Medicare Supplement Plan C?

Plan C is a higher cost plan and not always available in every market. The best thing to do is to get in contact with a professional that can help you go over your options before you make any decisions. Medicare supplements are standardized and while the benefits are the same from one company to the next, the current cost for that plan and in the future can vary greatly. We can help you make sure that you get the best plan for your dollar, offering you nothing but the best advice for you and your situation. Give us a call at 866-319-5886 or fill out the form below for more help. All of our help is 100% free to you.